Operating Profit and Net Profit: Measurements of Profitability

- pragati

- July 2, 2021

- Bookkeeping

- 0 Comments

For example, let’s say that your company has a lot of debt leading to high-interest expenses. Each of these metrics shows a profit at different moments of the production cycle and earnings process. COGS refers to the direct costs incurred in producing the goods and services sold by a company. If your sales are up, but your margins are down, you may need to take a deeper look at how you’re running your business.

This can be achieved by cross-selling and upselling complementary products to customers. This allows the company to sell more products and reduce the need for markdowns. Conducting daily inventory inspections and asking employees to record the number of items returned or broken can help keep track of stock levels. An effective inventory management system can help track stock levels and enable just-in-time ordering to avoid tying up too much capital in inventory. A product-packaging design that is less expensive can also be considered to save additional cost per item.

What operating margin doesn’t tell you

However, this information is useful for the business’s finance team to see where they are spending a lot of money and to determine ways to increase operating profit. Net profit, located at the bottom of the income statement, was $422,100 for the period, and was obtained by subtracting non-operating expenses ($28,500) and income taxes ($84,400) from operating profit. To how to track personal and business expenses in quickbooks calculate a profit margin, business owners need to calculate total revenue and total expenses. Research and development (R&D) costs are expensed in the year in which they occur, while depreciation expenses are spread out over the life of the asset. Operating income is also important because it’s one of the key inputs in the calculation of a company’s operating margin.

When managed correctly, increasing operating profit can be a helpful way to grow a company’s bottom line. One way to increase operating profit is to increase the average order value. Operating profit is a good metric to assess the company’s core profitability. It is also considered the “top line” figure because it appears at the top of an income statement. Studying your gross profit vs net profit numbers can provide you with the information you need to improve your business performance. One of the ways to do this is to focus on collecting the money that is due to you from the credit sales that you have made to customers.

Honda posts record operating profit for April to June period – The Japan Times

Honda posts record operating profit for April to June period.

Posted: Thu, 10 Aug 2023 07:00:00 GMT [source]

Often, the term income is substituted for net income, yet this is not preferred due to the possible ambiguity (Wikimedia Foundation, 2020) [15]. In simplistic terms, net profit is the money left over after paying all the expenses of an endeavor (Wikimedia Foundation, 2020) [15]. In practice this can get very complex in large organizations (Wikimedia Foundation, 2020) [15].

How confident are you in your long term financial plan?

But, operating profit looks at a company’s profit before removing interest and taxes. Some people may refer to this value as the earnings before interest and taxes (EBIT). Lenders, investors, and other stakeholders may consider your net profit margin to determine business profitability. Net profit margin is also a way for investors to compare two businesses regardless of size because the number is a percentage instead of a dollar amount. Your business’s profit margin will be drastically different from businesses in other industries. To determine how your business stacks up against other companies in your industry, you should look at the average profit margin by industry.

Revenue is found at the very top of an income statement, and all profitability calculations begin with revenue, which is why it’s often referred to as a company’s “top line” number. Operating profit is calculated by subtracting a company’s operating expenses from its gross profit. Additionally, the operating profit margin is often used as a metric to benchmark one company to other similar companies within the same industry. Operating profit margin is a profitability ratio used to determine the percentage of the profit the company generates from its operations before deducting the interest and taxes. It’s calculated by determining a business’s net profit as a percentage of revenue.

What is the importance of knowing operating profit?

Gross profit is the total revenue minus expenses directly related to the production of goods for sale, called the cost of goods sold (COGS). COGS represents direct labor, direct materials or raw materials, and a portion of manufacturing overhead tied to the production facility. Gross profit, operating profit, and net income are reflected on a company’s income statement, and each metric represents profit at different parts of the production cycle and earnings process. Operating profit margin is the ratio of operating profit to total revenue, and it is used to measure a company’s profitability and efficiency.

Gross profit is revenue minus a company’s COGS, which provides the profit from production or core operations. For example, a car manufacturer would show gross profit in the upper portion of its income statement, which represents the revenue from car sales minus COGS and any production costs directly tied to making cars. Net operating income (NOI) is a financial metric that measures the profitability of a business or property. It’s calculated by subtracting all operating expenses from total revenue, except for debt service and income taxes.

Is Income From Operations the Same Thing as Operating Income?

To put it another way, Diego made a credit sale in YEAR 1 and received the money due to him in YEAR 2. However, the level of knowledge that business owners have about their firms’ profits isn’t as precise. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The average company loses more than 20% of its productive capacity to organizational drag — the structures and processes that consume valuable time and prevent employees from getting things done.

- It shows how much your regular business activities earned during the reporting period.

- All additional income from secondary operations or investments and one-time payments for things such as the sale of assets are added.

- It symbolizes that how effectively and efficiently the company allocated its resources so that the best possible result is achieved at a very low cost.

- Net income is important because it shows a company’s profit for the period when taking into account all aspects of the business.

- Camino Financial offers small business loans at reasonable rates of interest.

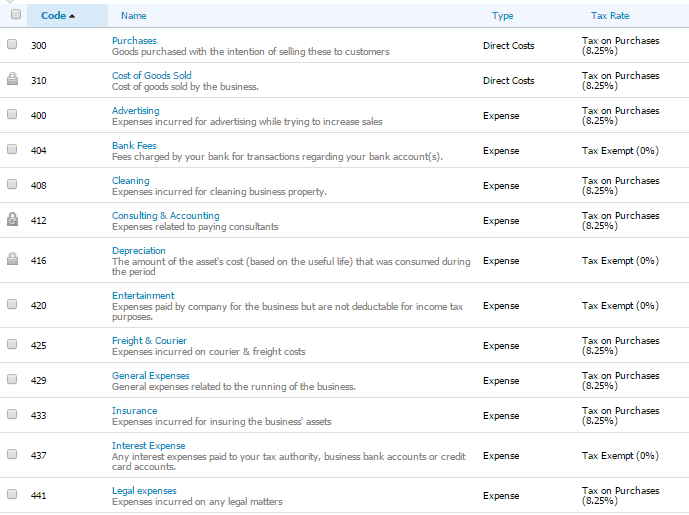

Please note that some companies list SG&A within operating expenses while others separate it out as its own line item. In general, a company must have enough operating profit to cover taxes and interest expenses to break even. Negative operating income means the company will require funding to maintain business operations. A company’s finance team will also use operating profit when reviewing spending and budgeting. Operating income is a great way to test profitability when compared to sales, and finance teams can use it to determine how well a company manages operating expenses. Investment bankers and finance professionals in mergers and acquisitions may use a company’s operating income when considering investment options and doing comparable company analyses.

Real Company Example: Walmart’s Operating Profit

A high-profit margin also sends a positive signal to potential investors, lending credibility and stability to the business. However, it’s important to note that increasing revenue alone won’t necessarily lead to profit growth if expenses also increase. Net Operating Income (NOI) is a crucial metric that measures the profitability of a business. Several factors can influence NOI, and understanding these factors can help you improve your bottom line. Operating profit does not include profits earned from investments and interests. Similarly, you may not have paid the supplier for some of the expenses that are accounted for.

China’s automakers bullish on growth after first-half success – China Daily

China’s automakers bullish on growth after first-half success.

Posted: Mon, 04 Sep 2023 01:50:00 GMT [source]

If net sales are high but operating income is low, it may be time to trim the budget. Your company’s income statement is the place you report both net revenue and operating income. It represents the income that the business generated during the reporting period covered by the statement. The key difference between operating income and net income is that operating income excludes interest and taxes while net income includes them.

Both these transactions will affect your net profit, but will not have an impact on your cash balance. Consequently, operating profit is also referred to as earnings before interest and tax. While gross profit is an essential measure of profitability, there are other profitability measures that you must also consider. However, after deducting all the costs that it has incurred, this falls to a net profit of $11,000. Bear in mind that the amount alone won’t help you to differentiate between gross profit vs net profit.

The net profit, on the other hand, is the profit after all expenses have been considered. Since net income is the last line at the bottom of the income statement, it’s also called the bottom line. Net income reflects the total residual income after accounting for all cash flows, both positive and negative.

Bonds, loans, convertible debt or lines of credit (Kagan, Investopedia, 2020) [12]. It is essentially calculated as the interest rate times the outstanding principal amount of the debt (Kagan, Investopedia, 2020) [12]. An interest expense is an accounting item that is incurred due to servicing debt. Interest expenses are often given favorable tax treatment (Kagan, Investopedia, 2020) [12]. For companies, the greater the interest expense the greater the potential impact on profitability. Coverage ratios can be used to dig deeper (Kagan, Investopedia, 2020) [12].

Net income is the “bottom line” for a company’s finances — all income left over after every obligation and expense is paid. Net income– also commonly referred to as “the bottom line” – is the final profit figure presented on the income statement. Net income represents the profit that remains after accounting for all income and expenses in the period. It includes all sources of income and expenses, even those unrelated to the business’s core operations. Net profit is often considered the most important type of profit since it reflects the true financial health of an organization.